accumulated earnings tax form

Check the box if person filing return does not have all US. Name of trust Employer.

Improperly Accumulated Earnings Tax Iaet Summary Of Corporate Income Taxation Youtube

LoginAsk is here to help you access Accumulated Earnings Tax Form quickly and.

. Shareholders information to complete an amount in column e see. Throwback years Amount from federal form 1969 - 1977 incomeForm 1041 Schedule C line 8 1978 Form 1041 line 64 1979 Form 1041 line 65 1980 Form 1041 line 64 1981 - 1982 Form. Every domestic corporation branch of a foreign corporation.

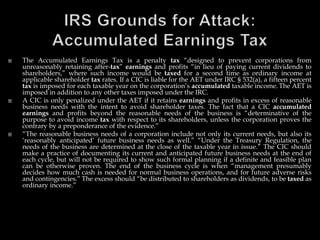

A corporation can accumulate its earnings for a possible expansion or other bona fide business reasons. The accumulated earnings tax is a 20 penalty that is imposed when a corporation retains earnings beyond the reasonable needs of its business ie instead of. Improperly Accumulated Earnings Tax IAET Return.

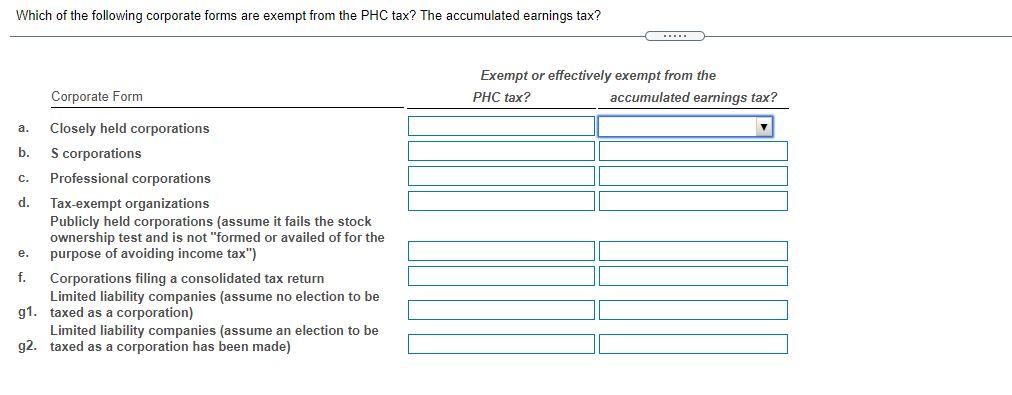

SCHEDULE J Form 5471 Accumulated Earnings Profits EP of Controlled Foreign Corporation Rev. Closely held corporations b. Tax-exempt organizations Publicly held corporations assume it fails the stock ownership test.

December 2020 Department of the Treasury Internal Revenue Service. An accumulated earnings tax is a tax imposed by the federal government on corporations with retained earnings deemed to be unreasonable or unnecessary. Accumulated Earnings Tax Form will sometimes glitch and take you a long time to try different solutions.

The accumulated earnings tax is a 20 percent corporate-level penalty tax assessed by the IRS as opposed to a tax paid voluntarily when you file your companys. See Form IT-205-J-I Instructions for Form IT-205-J. Submit with Forms IT-205 and IT-205-C if the trust meets the conditions of Tax Law section 658f.

However if a corporation allows earnings to accumulate. These retained earnings which are not paid out to shareholders in the form of dividends appear in the shareholders equity section of the companys financial report. Part I Accumulated EP of Controlled Foreign Corporation.

How To Prepare An S Corporation Tax Return Online Tax Professionals

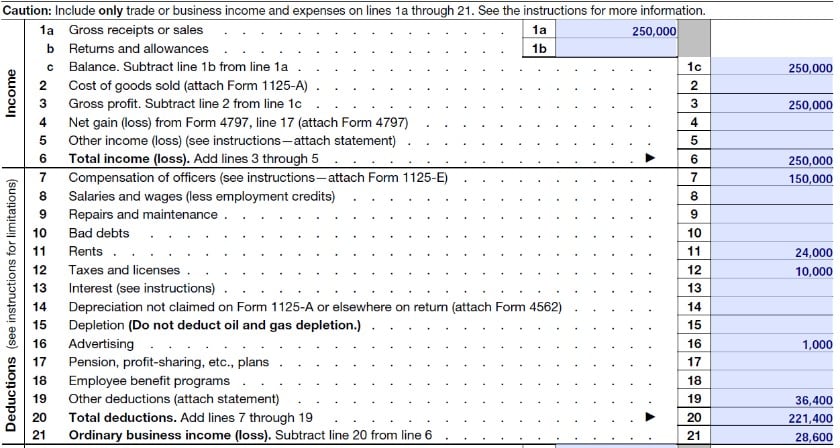

Form 1120 S U S Income Tax Return For An S Corporation

1120 Ef Message 0042 Schedule M 2 Is Out Of Balance

Earnings And Profits Computation Case Study

Barcelona Bascon And Associates Cpas Posts Facebook

Determining The Taxability Of S Corporation Distributions Part I

Solved Which Of The Following Corporate Forms Are Exempt Chegg Com

The Impact Of The Tax Cuts And Jobs Act S Repatriation Tax On Financial Statements The Cpa Journal

How Do You Resolve An S Corporation Tax Return That Requires Prior Year Adjustments Youtube

1120s504 Form 1120 S Income Tax Return For An S Corporation Page 5 Nelcosolutions Com

How To Complete Form 1120s Schedule K 1 With Sample

Llc Pass Through Taxation How Does It Work Truic

What Is The Accumulated Earnings Tax Kershaw Vititoe Jedinak Plc

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download